Possums,

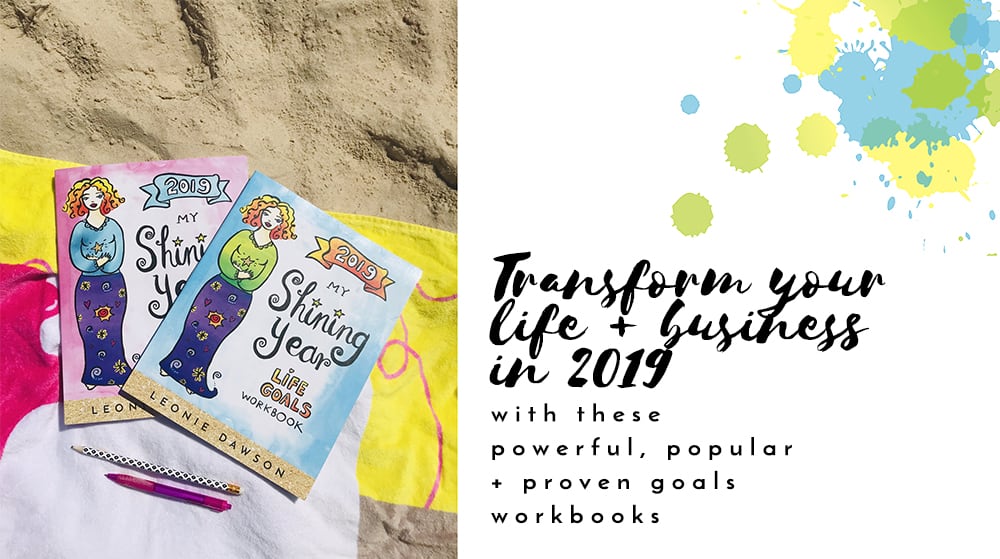

So. Me + Mr D have been doing our annual planning with the workbooks.

Talking through our family, health and finance goals. It’s so blooming good to do this. When we first started doing it, we were broke and crap with money. Savings = zip. Debt = a lot. But when you put attention on these things, it starts shifting. You start getting more intentional. Money starts working for you.

We’re far removed from where we once were: we are self-made multi-millionaires, and pretty financially savvy. But we still have a budget, and we still talk regularly about what we need to be doing with our money to be a good financial custodian.

The importance of being a good financial custodian

Financial literacy is probably the reason why most lotto winners are broke in a few years. They haven’t yet built up the skills and mindset on how to keep money. It’s one thing to have a lot of money, but it’s another thing to actually keep it blooming and growing. It’s a process that comes over time, with self-education and experience.

It’s funny the way we think about millionaires: we think LUXURY SPENDING. Cars, houses, fashion.

But in the excellent book, “The Millionaire Next Door” by Thomas J Stanley, research shows that kind of spending behaviour is for people trying to LOOK like millionaires. Real millionaires tend to instead be fairly conservative with their spending, and not look fancy. They get there is an art to being a good financial custodian, and that spending money isn’t something which grows their net worth (or their happiness). They also tend to be far more able to financially support causes that matter to them.

Anyways, this is a really long way round of saying: me + Mr D have been talking about money again as we work through the workbooks. Have you done your financial planning in your workbook yet? It’s so bloody important.

AND in that process, I’ve realised that I’m doing unconscious spending that isn’t contributing to my net worth or happiness.

Somewhere along the way I’ve started thinking that because I am a cashed up boganaire, I SHOULD be spending money. And I’ve gotten really lazy about spending: thinking I should rather than actually looking at needs and what I currently have that I could be using instead.

I’ve decided to do a No Spend experiment to reset my financial barometers again.

For me, the best way to make a resolution is to do it publicly. (Probably because I’m an Obliger tendency according to this fantastic book.)

I also feel like reducing consumption is an important part of environmental conservation.

So here I am. No Spend Leonie.

Funnily enough, as I was writing this, my friend Jen Storer wrote about her Depth Year and I realised that’s exactly what I’m doing!

“What if, for a whole year, you stopped acquiring new things or taking on new pursuits. Instead, you return to abandoned projects, stalled hobbies, unread books and other neglected intentions, and go deeper with them than you ever have before.”

Let’s talk through the details, yeah? This is for me too, helping me plan out the problem parts.

Where do I spend the most?

Books are my favourite thing to buy. I think nothing of dropping $100-$200 in a bookstore or online book order regularly.

And yet: I have an extraordinary number of books that I haven’t read. I also have a Kindle Unlimited subscription. AND I have an excellent local library.

Time to enjoy what I have!

Update: I’ve created a written list of the books I currently own that I haven’t read. 223 (!!!!!) not including vast amounts in storage. I’ve decided to cancel my Kindle Unlimited Subscription and read only what I currently have.

This has been another favourite shopping pleasure of mine. But I have SO much stuff already. And it can get super pricey super quickly. So I’ll use what I have, and get creative!

Mate, the shit I have can fill rooms. I don’t need more stuff.

HOWEVER: I’m giving myself two opt-outs here. I am in dire need of some new canvasses, and have been meaning to get some for a month. Being an artist is kind of my job, and one of my favourite things in the world. So if I need canvasses, I’ll get ’em. Also, I sometimes like to do cross stitch. I’ve used up the kits I have currently, but if I want to do more, I’ll get myself ONE until I am ready for the next one.

Potential problem areas I need to watch out for: I think one of my biggest spending issues is that I usually buy things online. And when I do, I buy a bigger order to make the shipping cost “worth it”. If I really, really need to buy something online, I need to just buy what I need, not aim for the free shipping amount.

I am not much of a clothes person anyway. I just couldn’t give a shit. Everyday wear is a pair of hippy pants and a printed graphic t-shirt. I’ve got a crap tonne of undies and bras.

Potential problem areas I need to watch out for: this is kind of ridiculous, but I can totally forget to wash my clothes. And then wonder why I don’t have any clothes to wear. And then I buy more. I just need to do washing when I run out of clothes! PROBLEM SOLVED!

I’ve got piles of it. Now to just USE IT.

Potential issue: I have one art journal here, and the rest of my stock is in storage. My blank art journals are by far my most important piece of stationery. A couple of years ago, I went a bit nuts and bought a case of 20 of my favourite art journals so I would never be without them. I’ve used the exact same journal type for the last 20 years – since I was 16! Anyways, that stock is in storage now until we find our next house. So I’ve got one journal to tide me over until then. They usually last me about 3-4 months. If the end of the journal comes before our new house does, I will need to get me another one. OR! I could do something COMPLETELY CRAZY and… use a different kind of journal as my art journal. Phwoar. I think I’ve just blown my own mind right there.

We will see what happens. I’m just spitballing possibilities here. If I need to buy myself another $10 journal, so be it! I just want to be really intentional with my purchases instead of unconscious.

In terms of pens, I THINK I have enough stock to get me through at least a few months. If I run out, I need to dig around in boxes: I’m sure there is SO much stationery around!

This one was actually the first thing I started fretting about when I thought about my No Spend Experiment. I like to buy magazines not for the purpose of reading (though I DO read them!) – instead their chief purpose is for collage supplies for my art journalling. I’ve been chopping up magazines since childhood. Ha!

Things I can do to work with this issue: I need to organise my creative space. I found 2 brand new magazines that I’d bought and didn’t even take out of the paper bag from months ago. I also have scrapbook paper I can use instead. And it could create an opportunity for a different kind of journaling/creative experience.

As a last resort, I could get some from a charity or tip shop.

I do like to treat my friends and family! Gift giving is one of my love languages.

I can probably be way more creative though: make thoughtful things for them. Consider other ways I can send love.

It’s amazing what shit I can buy at Big W or Kmart. It’s not even a specific thing… it’s just because they are cheap and accessible, really. I want to be way more intentional about giving Big W my $.

Potential problem areas I need to watch out for: my husband and kids LOVE Big W. It’s next to our local post office and always feels so easy just to stroll on into. Mr D buys practical shit for the house. The kids use their pocket money to buy something. This is my experiment, not theirs. Having said that, Mr D does want to be more intentional as well, so we will probably cut down our number of trips there.

Like all homeschool mamas, I went NUTS on buying books and curriculum for homeschooling. And haven’t even used 10% of what I’ve bought. This year, I want to use what we’ve got and not buy anything more.

I’ve also got an Education.com subscription, and I can also look at Pinterest and make supplies we need as well! Like today I was lusting over some flash cards and realised I could make them super easily, and they would probably be way cuter too.

I order all my skin care supplies and hair care through doTERRA as part of my monthly order.

I make my skin care using their essential oils, and use it for almost everything healthcare, soulcare and bodycare.

I only order what I need anyway, plus I reckon it’s a good preventative healthcare expense.

This one I am not sure on. On one hand, I LOVE encouraging literacy with my kids. On the other hand, we have SO MANY books already. I think the solution is: make full use of the library instead (which we already do). And let them use their own pocket money on books. And if Mr D wants to get books for them on occasion, I’ll follow his instinct.

We pretty much are sorted on this front. The only thing that may need replenishing in their wardrobe is leggings in winter. Still, that’s 6 months away. And there are some there already. Again: I just need to be intentional.

And make sure I JUST DO THE DAMN WASHING when we run out of clothes!

I’ll cover these in my next post… that’s a whole other thing to discuss!

Areas my No Spend Experience doesn’t cover:

- Cafes. Mama likes her cafes. I’ve thought about doing a no spend experience on cafes, but honestly, that would cut a huge chunk of enjoyment out of my life. Mr D suggests we only go there on weekends as a treat. WE WILL SEE.

- Mr D’s spending. He spends fuck all anyway. He’s the kind of dude that will splash out and buy himself a $6 computer mouse and be thrilled and tell me all about it. He’s super conscious of his spending habits, and I have no interest or need to moderate them. It’s my unintentional spending that is my area of concern.

- Car. We will probably trade in our old van for a new car this year. We bought the van second-hand fairly cheaply years ago. I’m wanting to get a new car with better safety features because I am officially middle aged (is 36 middle aged? I’m middle aged in my soul anyway) and I care about things like SAFETY and LAP BLANKETS and RETIREMENT FUNDS.

- House. We’ve been saving up for a new larger house for three years. That will probably happen this year.

How long will this experiment go for?

Good question. I want to do as much of this year as possible.

I am also not going to be militant about it. I just don’t have that personality type.

If I mess up, I’m not going to be cross with myself. Just keep turning up and being more intentional and doing better.

The point of this all is to reset my spending barometer.

I’m thinking about maybe keeping track of all the purchases I do make, just so I am super clear to begin with.

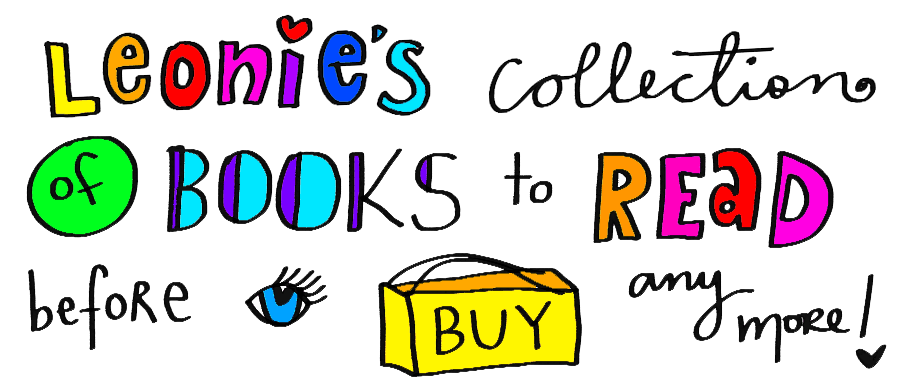

Or even writing a list of all the books I do have sitting on my bookshelves and crossing them off as I go. How fun does that sound?

And most of all: enjoying what I have.

There’s so much to love already. I don’t need more.

Big love,

I’ve also created two pages to document this experiment in further detail:

Leonie’s Collection of Books To Read Before I Buy Any More!