Please note: this is not financial advice! I just wanted to share what I’m loving, learning & thinking about. Before you make any financial decisions, make sure you talk to a financial advisor! Also: this is not a sponsored post. I don’t ever do them, so you don’t have to wonder about that!

Pooky bears,

Mama Leonie LOVES talking about money and investing. And I love learning about money too – what other people do with it, how to be an even better custodian for it.

I wanted to tell you about the investment I’m most excited about lately. (And if you want to get even more behind the scenes in my finances & learn the easy but powerful ways to reduce your debt and increase your savings, Money, Manifesting & Multiple Streams of Income is the right place for you. It’s doubling in price at end of the month, so if you want it, grab it now to save $$$)

Psst! Wanna listen as you read?

Just hit play above, or subscribe via Apple Podcasts, Spotify, PocketCast (or wherever else you listen to podcasts!)

Early last year I made a big change with our retirement funds.

It was fuelled by the hellish Australian bushfires and my awakening to the climate crisis.

I decided it was time to put my (retirement) money where my mouth is, and move it from a normal retirement fund into an ethical retirement fund. Specifically: a fund that does not invest in mining, gambling, tobacco, guns, human rights abuses, logging etc. Instead they invest in clean energy, sustainable solutions, innovative tech and more.

I ended up choosing Australian Ethical and the transfer process was super simple… it honestly took me a couple of minutes online, and all it needed was my tax file number… it was pretty bloody amazing! I put it off for so long thinking it would be hard, but it was so stupidly simple.

There are a bunch of other similar funds in Australia including:

- Verve Super (women run)

- Future Super

- traditional super funds often have an “ethical” or “environmental” option as well.

Honestly, it’s about the best thing since sliced bread. The more people move their superannuation funds into ethical options, the more it becomes difficult to fund invasive mining operations, gambling and tobacco.

Plus: it makes good investing sense. The way of the future is sustainable, as evidenced by the world’s largest fund manager dumping thermal coal as an investment.

Hot tip: if you do decide to move, make sure you take into account life insurances & other insurances that are often attached to your super! Sometimes they are calculated by how long you have contributed, so a move may hurt your life insurance.

Making my super ethical totally made me excited to do more ethical investing!

I ended up doing an interview on the Ethical Change podcast with Bindi Heit. She mentioned she not only had moved her super into ethical funds, but had invested in ethical managed funds too.

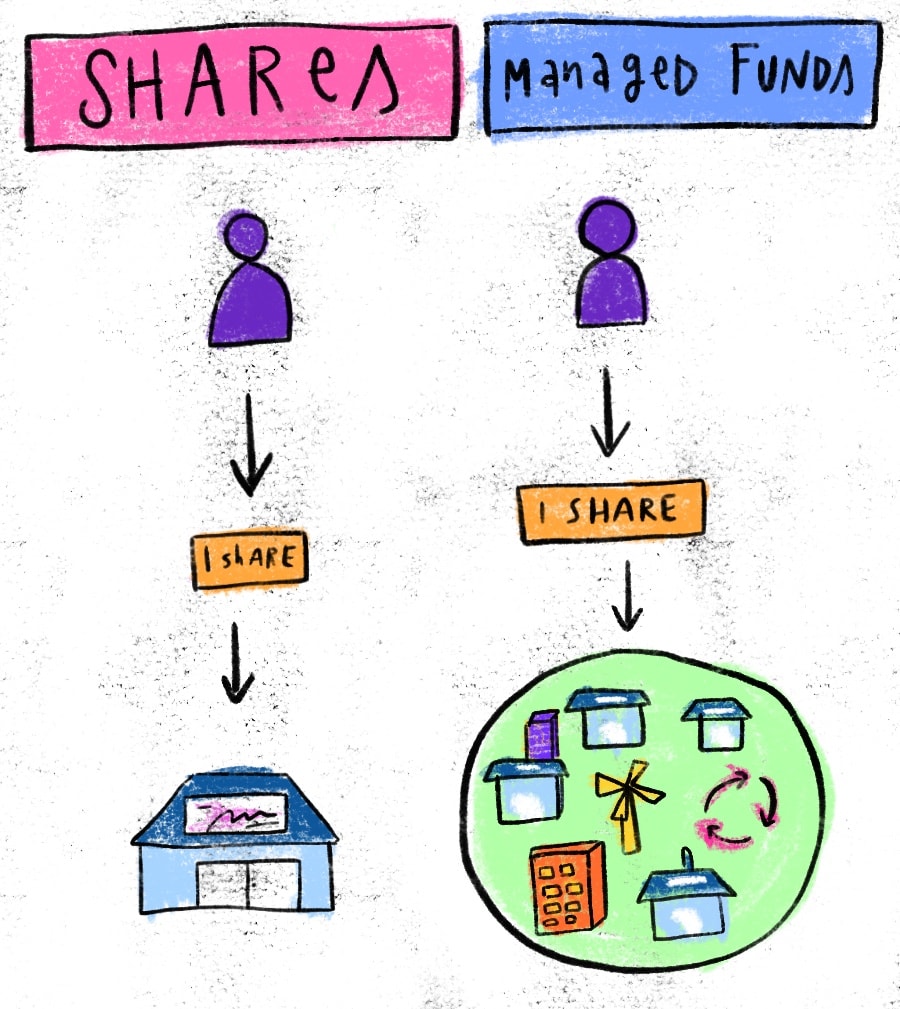

That of course made my wee ears prick up, and I researched further. I didn’t actually know what managed funds were. All I knew about was shares – buying particular stocks in a company.

Managed funds is like a collection of shares. So instead of picking ONE company to invest in (and exposing yourself to the risk of all your eggs in one basket), you instead invest in a whole bunch of companies at once (so many eggs in your basket!). When you buy one share in a managed fund, that share gives you mini-shares in all the companies the fund are invested in.

Which is exactly what’s happening with your superannuation – your money is invested in a big ole range of companies! You don’t have to decide what stocks to buy and sell, the fund does. And in the case of ethical managed funds, they also make sure the companies are sustainable.

Plus: it makes good investing sense. The way of the future is sustainable, as evidenced by the world’s largest fund manager dumping thermal coal as an investment.

Paul Jarvis describes managed funds/EFTs as an investment burrito. As in – you’re not buying one single ingredient, you’re buying a whole bunch of things wrapped into one.

I must admit – I’m pretty shithouse at buying individual shares.

I held shares for YEARS in Woolworths (one of Australia’s biggest grocery stores)… and sold them about 2 weeks before the pandemic started and Woolworth’s sales went gangbusters. LOLLLLLZ. LOLLLLLLLZ I SAY.

Learning about shares & keeping an eye on the stock market regularly isn’t a big passion of mine – not enough to be great at it anyway. I like that I can invest in managed funds instead, and they can do manage it for me, and mitigate my risk a lot more.

Ethical Managed Funds > Managed Funds

This was the part that excited me most – that not only could I get managed funds, but I could choose ETHICAL managed funds. They follow the same guidelines as ethical super – they usually don’t invest in mining, gambling, tobacco, guns, human rights abuses, logging etc. Instead they invest in clean energy, sustainable solutions, innovative tech and more.

That makes me super happy. I want to make sure I put my money where my mouth is.

Because I was already set up, I used Australian Ethical again for managed funds. Again: there are plenty of options out there for this. Again, this is not a sponsored post. Aus Ethical have no fucking clue who I am. I’m just a bossy motherfucker who likes to talk about everything I’m excited by!

What’s my end goal?

Eventually I’d like to get to a point where we can live off the returns of our investment portfolio without our balance going down. I reckon I’ll need about $3 million in managed funds to get there. I’m already over a third of the way there which is exciting. At the rate I’m going at, I’ll be able to fully retire easily at 45, but I don’t think I’ll retire… I like blogging and creating and making shit far too much. Plus, I’ve been partially retired since I was 27 – I’ve only worked 10 hours a week since then.

We do have other investments and income streams, which I go into deep detail about in Money, Manifesting & Multiple Streams of Income. They will factor into retirement funding and I won’t need as much as that, but I like having one clear simple goal to fixate on and work towards.

I’ll be honest – I used to have a really shit attitude about money. I thought it was selfish and shallow to care about money at all. Meanwhile… I didn’t have the cash to do anything to help what I cared about.

I love being abundant now.

I love having extra funds we can easily donate to charities we give a fuck about. For example – last year we could donate $25,000 to Australian Wildlife Conservancy to help them buy more land for wildlife. I love that we can offer up to 400 scholarships a year. I love knowing we can choose alternative education options for our kids. I love that we can take care of our extended family when we need to.

I reckon the world needs more of us… heart centred hippies who give a fuck about the world, and will redirect funds to the places that need it!

If you’ve got any other money questions, pop me an email (support@leoniedawson.com) and I’ll see if I can answer them in a future blog post.

And I know as well that talking about money can be very triggering. I want to send you love to exactly where you are right now. Thank you for listening to my sharing. I hope in some ways it is useful.

To womxn being bold and brave and financially savvy!

Big love,