Babes,

I read “Billionaire In Training” last year, and found it useful.

I had enough highlighted sections I kept a copy on my favourite bookshelf, but I’m now decluttering and want to get rid of it. So I thought I’d write up my notes to keep here instead… and make them public because you might find them useful as well!

“Billionaire In Training” by Brad Sugars details how to buy, grow and sell businesses to become wealthier. Brad is an Australian entrepreneur who has owned companies in everything from business consulting, insurance, property investment, dog food, ladies fashion retail, pizza manufacturing and wholesale.

Entrepreneurial Skills

- It doesn’t take much to outperform your competitors in business. You only need to do some basic, commonsense things to win in the minds of customers.

- Becoming great at sales requires a lot of reading, learning and application.

- Bringing in the cashflow is by far the most important area for any company

- You can cut costs, but you can only sell your way to prosperity.

- Everyone in the world knows more than you and me – about everything. We just need to ask the right questions and listen long enough to find what that “something” is.

- Revenue streams in businesses can jump massively in a couple of weeks, day or hours. A 10% increase in income can double or triple the profits, thus doubling or tripling the paper value of the company.

- Steps to success: invest in knowledge, absorb knowledge, apply knowledge & take action.

- Doing the work is one side of the seesaw and sales and marketing is the other.

- Bigger is not always better.

- Systems should run a business and people should run the systems.

- The aim of the game isn’t to work harder, it’s to create better results with less effort. It’s about finding ways of achieving more with less.

- Create an income stream that flows whether you work or not, and gets better all the time.

- Brad makes cashflow from businesses and keeps money/assets growing in property. Doesn’t like property for generating cashflow – prefers businesses.

- Brad’s definition of a business: a commercial, profitable enterprise that works without him.

Wealthy Mindset

- Most people’s only relationship with money is of never having enough. Most people live a “paycheck to paycheck” existence and use this month’s paycheck to pay off last month’s bills. Most people spend every dollar they earn, and then some.

- If you believe that “stuff” is more important than wealth, you will always use money poorly. Spend your life buying stuff and you’ll end up with stuff all.

- Trust that you’ll learn along the way, trust you’ll make mistakes but that you can recover. Trust that the only way to truly learn how to be an entrepreneur is just to get started.

- It’s easy to choose success over failure. What’s hard to do is rechoose that same goal, that same dream, that same level of success every single day, every single hour, until it becomes a reality.

- Understand the difference between a holding company and a trading company. You should always have two companies rather than one: one to own the assets, the other to trade and make the ongoing profits.

- Make money with money to create wealth.

- Tell yourself you are a money magnet and you’ll come across many interesting propositions that you wouldn’t have noticed before.

- Buy businesses/property/everything at wholesale and sell retail.

Three Stages of Getting Wealthy

- Stage 1: get yourself to a stage where you’ve made enough investments over time to give you what I call a passive income rather than a paycheck existence. In other words, your investments and businesses make money whether you get out of bed or not. (Leonie says: First stage? WTF! I thought that was the end goal! Woops! Time for me to expand my mindset!)

- Stage 2: Passive Income + Physical Assets

Assets must have both capital growth and income. If they don’t, then they are not assets. - Stage 3: Passive Income + Physical Assets + Paper Assets

Paper assets: shares, contracts, licenses, royalties, franchise documentation.

Property

- You can buy property for much less than it’s worth – people will sell for less than it’s worth because they can’t wait.

- Shop around and negotiate well.

- You can easily add value to a property with a few simple and cost-effective renovation and cleanup techniques.

- Invest in the dirt more than the building.

- Brad doesn’t like units – unless he owns the whole block.

- Brad uses debt to finance properties.

- The best deals are out there waiting for those of us who’ve bothered to read one or two books on property, learn about what we are doing, and then put in the time to find the deals.

Buying & Selling Businesses

- Find a company that isn’t performing anywhere near its true potential, buy it at rock-bottom price, build it up quickly using all the knowledge, skills and systems you have learned or developed, and then sell it for a premium price.

- You also need to find good jockeys – good people with whom to build up those companies.

- Get a good deal & never pay full asking price.

- The value of a business is determined only by two things: revenues and profit.

- Don’t sell your business until you have a business with greater cashflow to replace it.

- Walk away from more deals than you make.

- Look at 50 businesses, make an offer on 10 of them, negotiate 3 of the 10 to get a great deal, should be able to get financing for just 1 of the 3.

- Starting a business from scratch can take more time than buying an existing business that’s already profitable or just about profitable.

- Brad recommends buying businesses for less than half of what they are advertised for.

- Make sure you get the previous owner to work with you for up to a month as part of the purchase price to train you.

- You don’t make profit when you sell – you make it when you buy. Negotiate from zero.

- Fall in love with the deal, not the business.

- Your job in growing a business is finished when all the systems are in place, allowing it to run without you.

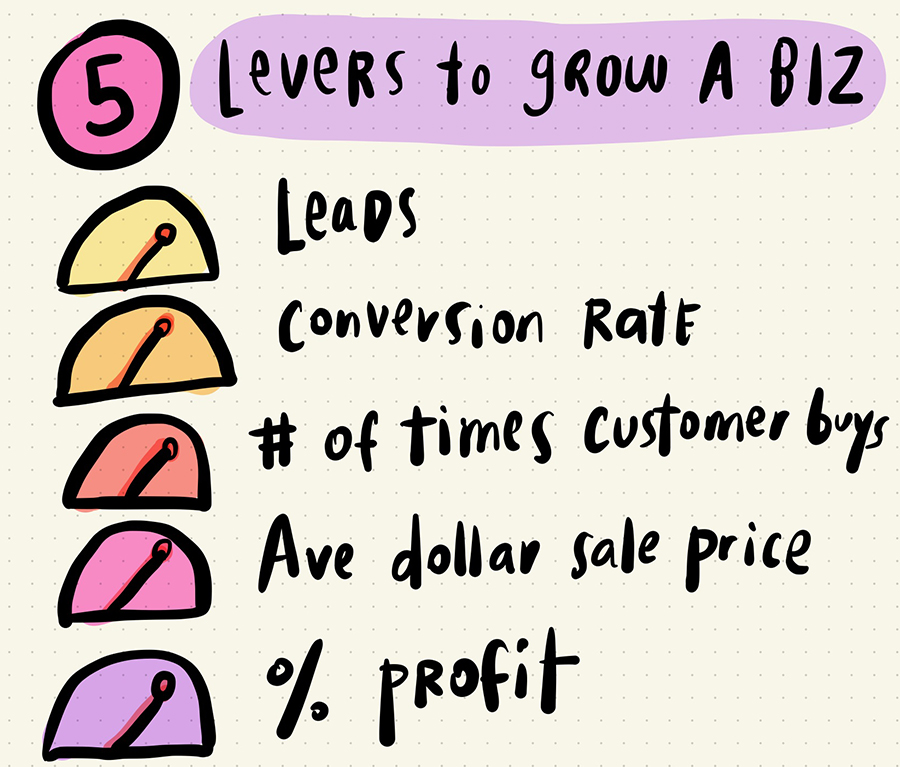

Five levers to grow a business

- Leads (prospects or potential customers)

- Conversion rate (difference between those who could have bought and those you did)

- Average number of times each customer buys from you each year

- Average dollar sale price

- Percent of each sale that’s profit

How to affect business growth levers

- Leads: advertising, sponsorships, PR, competitions

- Conversion rate: promotions, improving sales techniques, first buyer’s incentives

- Number of transactions: underpromise and overdeliver, keep in regular contact, free trials

- Average dollar sale: increase prices, upsell, upgrade purchases, add-on selling, incentives for bigger purchases

- Margin: reduce overheads, sell online, sell higher-priced items

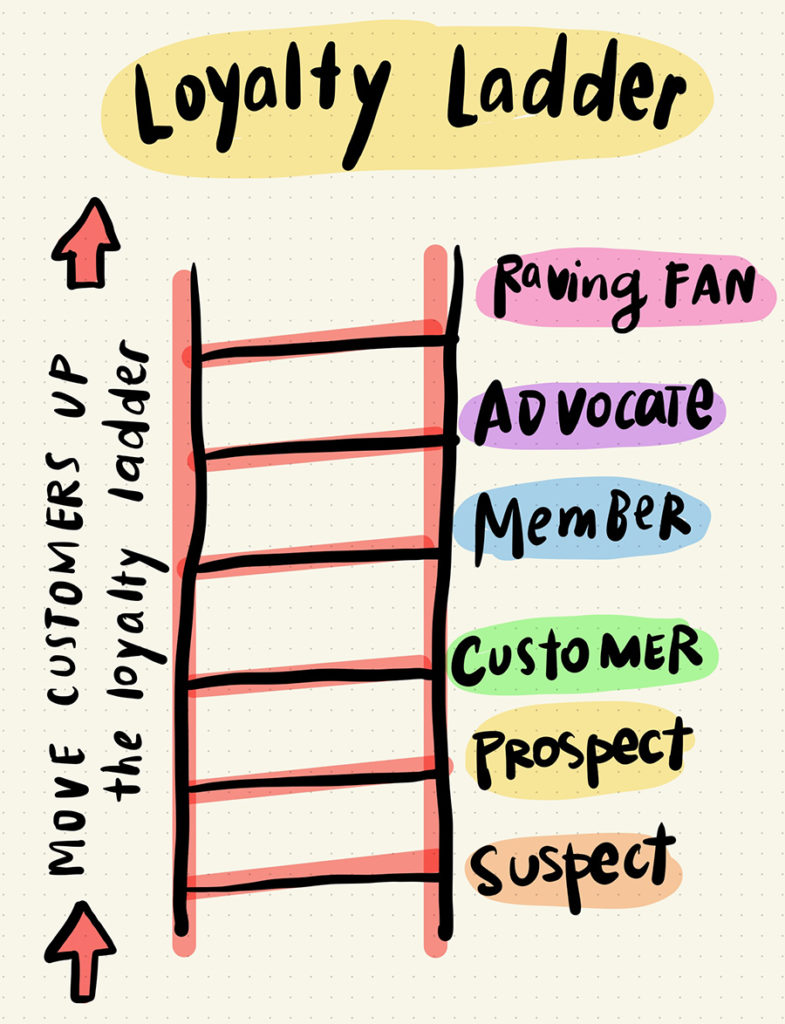

Loyalty Ladder

Get people to move up your ladder.

The rungs of the loyalty ladder:

- Suspect: Potential customer

- Prospect: Adding to database

- Customer Has spent money with you

- Member: Spent money with you twice, starting a feeling of belonging

- Advocate: Sells you to other people. Gives referrals or promotes you. Keeps buying.

- Raving Fan: Someone who can’t stop selling for you. They want to see you succeed. Keep buying.

Hope you’ve found this useful!

If you want to read the book in full, you can find it here: “Billionaire In Training” by Brad Sugars

Sending you much book love,

FREE GOODIES:

BOOKS:

- Goal Getter workbooks for 2022 & beyond!

- Calm Christmas Planner

- Salt: a hottttt romance novella (published under my pen name Lola Leigh)

COURSES:

- Work Less, Earn More

- Behind The Scenes of a Multi-Millionaire’s Finances (only $7!)

- Sales Star

- Marketing Without Social Media

- Money, Manifesting & Multiple Streams of Income

- 40 Days To A Finished Book

- 40 Days To Create & Sell Your E-Course